Tax Regulations and Compliance

Staying Ahead - Evolving Tax Regulations and Compliance in Australia

As your trusted accounting partner, at IQ Accountants, we know that tax isn’t just a once-a-year task—it’s an ongoing responsibility that can shift dramatically with changes in legislation, compliance standards, and ATO focus areas.

Over the past few years, Australia has seen significant updates to tax rules across multiple sectors. From small businesses and sole traders to investors and high-net-worth individuals, staying compliant in this evolving landscape is more important than ever.

Here’s what you need to know—and how we can help you stay ahead.

🚨 Why Tax Compliance Is Getting Tougher

The Australian Taxation Office (ATO) has ramped up its digital systems, data-matching technology, and focus on tax transparency. With real-time data from employers, banks, cryptocurrency exchanges, and even platforms like Uber and Airbnb, the ATO has never been more capable of detecting inconsistencies and errors.

What this means for you:

Even honest mistakes can trigger an audit or penalty, which is why up-to-date advice and accurate reporting are more critical than ever.

🔍 Key Tax Changes Affecting Individuals and Businesses

- Digital Economy Reporting: Online sellers and gig economy workers are now more closely monitored, with new rules tightening reporting obligations on platforms like Etsy, Uber, and Airbnb.

- Crypto Tax Crackdown: The ATO is actively targeting cryptocurrency investors. Whether you’ve traded, swapped, staked, or earned crypto, they will most likely find out. There are some crypto platforms that have an agreement with the ATO to hand over your personal information.

- Instant Asset Write-Off Adjustments: These have changed multiple times post-COVID, so knowing which financial year your assets fall under is vital.

- Director ID Requirements: Directors of companies must now apply for a Director ID—a compliance step many forget but is legally required.

- Fringe Benefits Tax (FBT): Changing workplace trends (like work-from-home setups and electric vehicles) are reshaping how FBT applies to company perks.

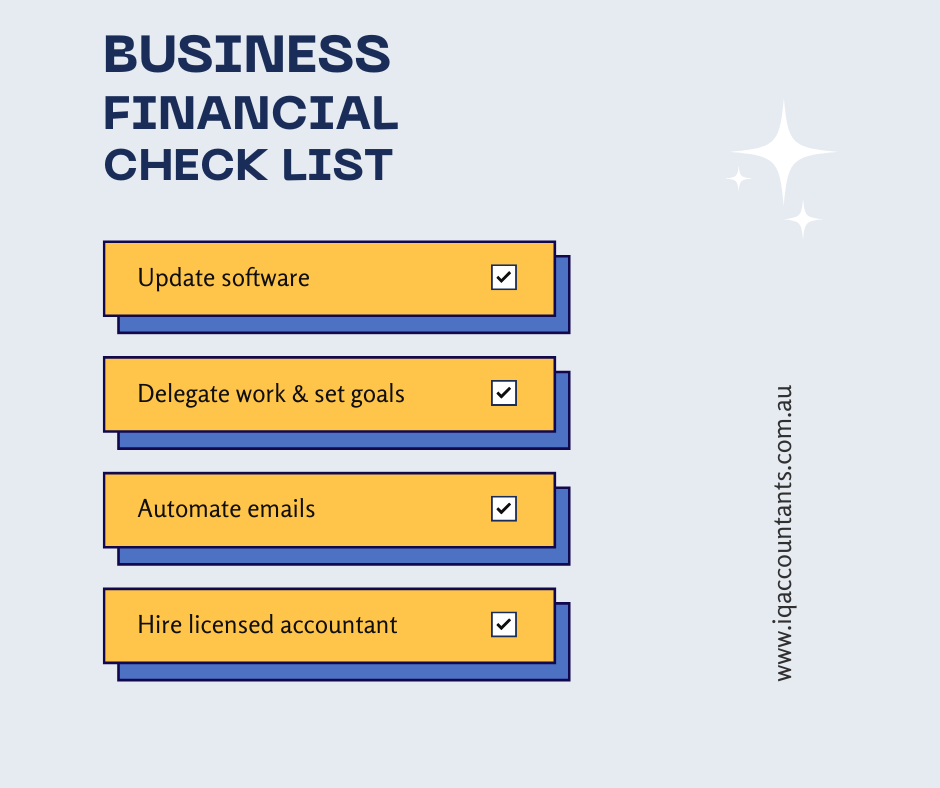

💼 How IQ Accountants Help Keep Their Clients Compliant

At IQ Accountants, we keep our clients up to date with changes that impact their specific situation. Whether it’s setting up payroll software that complies with Single Touch Payroll (STP) Phase 2, or structuring your investments tax-effectively, we translate ATO language into real-world action.

We don’t just tick boxes—we educate, strategise, and support. Our job is to keep you compliant and ahead of the game.

🤔 Commonly Asked Questions

Q: Do I really need to report crypto transactions if I haven’t cashed out?

A: Yes. Even swapping one coin for another or staking rewards is considered a taxable event. The ATO receives data from major exchanges and expects it to be declared.

Q: Can I still claim work-from-home expenses in 2025?

A: Yes, but the ATO has simplified the methods. The “fixed rate” method (now 67c per hour) includes phone, internet, electricity, and more. You’ll need detailed logs—no more shortcuts.

Q: What happens if I make a mistake in my tax return?

A: Mistakes happen. It’s best to amend it as soon as possible. The ATO is often more lenient when you’re proactive—but penalties apply if they discover it first.

Australian Tax Accountant

As Australia’s tax landscape continues to shift, having a knowledgeable tax accountant in your corner is no longer a luxury—it’s a necessity. Whether you’re running a business, building wealth, or just trying to stay on the right side of the ATO, we’re here to simplify the complex and protect your financial future.

Need help navigating the latest tax changes?

Let’s chat. The earlier we plan, the better the outcome.

Get in touch with the IQ team today – Call: (07) 5576 0011